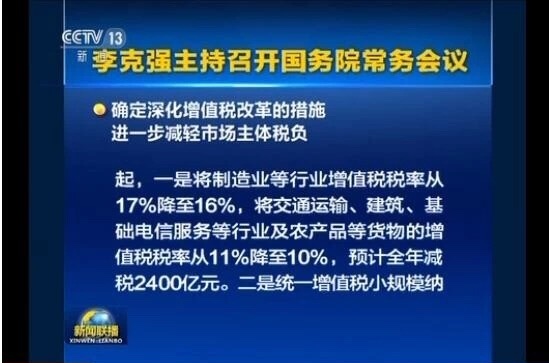

On March 28, the Premier of the State Council, Li Keqiang, presided over the executive meeting of the State Council and determined the measures about deepening the reform of the value-added tax and further reduce the tax burden on market participants.

From May 1, 2018, the value-added tax rate in the manufacturing industry and other industries will fall from 17% to 16%, and the value-added tax rate for goods such as transportation, construction, basic telecommunications services and agricultural products will fall from 11% to 10%. %. In addition, the annual sales standard for small-scale taxpayers in industry and commerce has been uniformly raised to 5 million yuan, and some input taxes that have not been deducted within a certain period of time have been refunded for some advanced manufacturing industries, modern service industry companies, and power grid companies.

The above three measures will reduce the tax burden of market entities by more than 400 billion yuan throughout the year, and domestic and foreign-funded enterprises will benefit equally. The meeting pointed out that this move is to further improve the tax system, support the development of the real economy such as manufacturing, small and micro enterprises, and continue to reduce the burden on the market.

The State Council executive meeting also unified the standards for small-scale vat payers. The annual sales standards for small-scale taxpayers of industrial enterprises and commercial enterprises were 500,000 yuan and 800,000 yuan, respectively, and this time they were uniformly raised to 5 million yuan.

This tax cuts have really benefited the refractory companies. The author believes that the refractories will see this point and realize the meaning of the heart's leaps and bounds at this moment. Upstream and downstream refractories and surrounding companies will all benefits from the tax cuts. This VAT policy adjustment is generally expected by the market and companies are looking forward to it. Tax cuts exceed market expectations and will bring huge benefits to refractory materials companies. This shows that China's value-added tax has been steadily progressing along the established modern value-added tax reform goals. . This time, tax cuts have been highlighted, and the support for the economic capillaries—small and medium-sized enterprises, start-up companies, and new economic forces—advanced manufacturing and modern service industries has become more apparent. Improve the annual sales standards for small-scale taxpayers, allow more small and medium-sized refractories companies and start-ups to enjoy tax incentives, directly increase the return on investment of beneficiary enterprises, help stimulate public entrepreneurship and encourage innovation among many people and create more innovations. At the same time, it will also help ease the financial pressure on the company during the initial period, and accelerate the phase of supply expansion into the company.